Apply now for Admission

The Bachelor of Commerce (BCom) Corporate Accounting and Taxation course is an undergraduate course that emphasizes on subjects related to efficient planning strategies included in financial analysis, taxation, and marketing. It covers topics like operations, risk monitoring, risk identification, strategic planning, advertising and marketing, financial management, regulation, and recovery of assets. It is theory-based and covers important topics like investments, banking, securities, stocks, trade, planning, and management of financial resources and shares assessment. Candidates will have diverse knowledge about the characteristics and policies of planning, analysis, monitoring, and coordination of finance after successful completion of the course.

Skills like decision-making, analytical reasoning, negotiation, project management, logical reasoning, critical analysis, work under pressure, leadership, teamwork, decision-making, and entrepreneurship are enhanced through this course.

|

DURATION |

3 years |

|

RECOGNITION AND ACCREDITATION |

|

|

AFFILIATION |

Private University |

|

ACADEMIC SYSTEM |

Semester System |

|

ENTRANCE EXAMINATIONS |

|

|

ENTRANCE EXAMINATION PATTERN |

Syllabus:

|

|

FEE STRUCTURE |

|

|

SALARY RANGE |

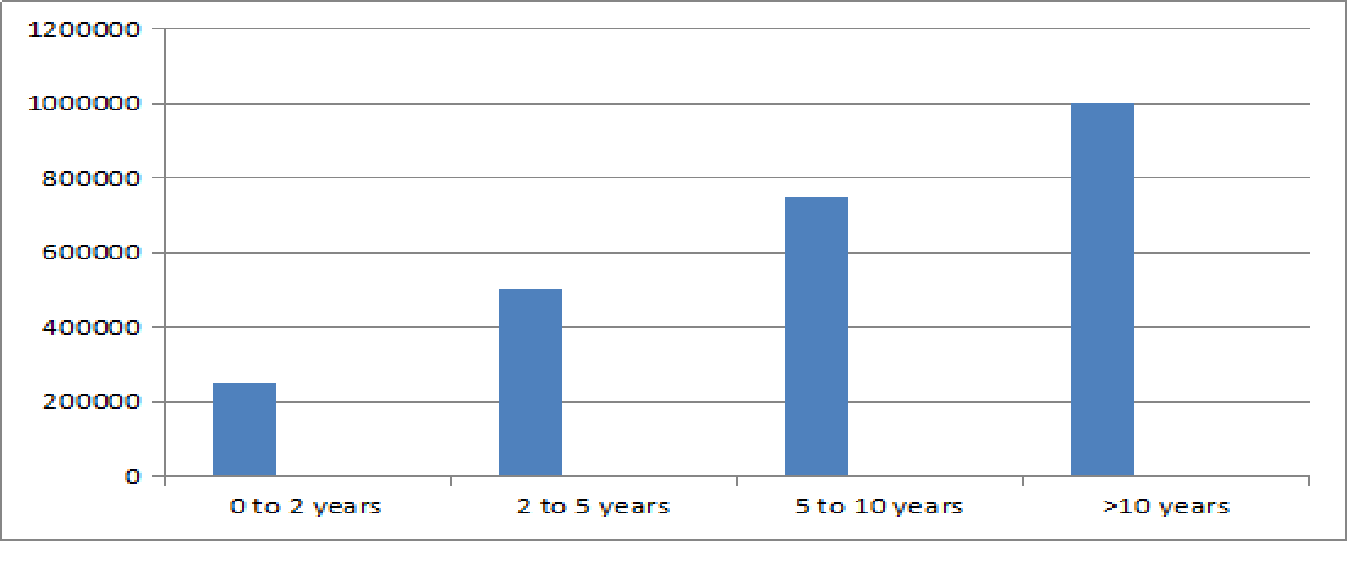

Between Rs. 2.5 Lakhs to 10 Lakhs p.a. |

|

CAREER AREAS |

|

Possible career opportunities:

Candidates can pursue higher studies after course completion:

MBA

Doctorate

0 Comments

Add comment: